The Secret to Unlimited Insights

The big idea used by the most successful individuals (that no one knows about).

I just finished a book that holds the secret to generating insights and solutions from anything.

Seriously, this one idea will make you a sharper investor, clearer thinker, and more creative entrepreneur.

The best part? Barely anyone else is doing it.

It's a way of thinking used quietly by the world's most successful minds.

Today, I’m going to give you the tools to consistently generate useful, original insights; anytime, anywhere.

This is your intellectual edge. This is how you outperform, by looking at the same situation as everyone else yet coming away with deeper answers.

It’s simple, but not easy, as anything worth doing usually is.

The idea is a mental model from a book called Lateral Thinking. It is a way of thinking (called lateral thinking…) that will revolutionise the way you approach problems and situations.

I have teased its contents in two other episodes, one on problem solving using analogies, and one on the dangers of being blocked by adequacy.

So grab a coffee. This one’s a bit of a journey, but I promise it’s worth every step.

This episode is the result of many hours of reading, thinking, and writing, I truly believe if you read until the end, the ideas on offer could shift how you think forever.

If you're willing to invest the time, the returns can be lifelong.

Let’s begin!

The way the mind works:

Our mind is a very complex information handling system, a very effective information handling system too.

However, it has its limitations. Its limitations and its advantages are inseparable since they both arise directly from the nature of the system.

Lateral thinking is today’s topic, and it is our method of compensating for these disadvantages (without losing any of the advantages).

The mind works similar to a library, it is a code communication system.

When you go into a library to get a book you could describe in detail the book you wanted, giving author, title, general outline etc. Instead of all that you could just give the code number from the catalogue.

Communication by code can only work if there are preset patterns.

Our mind overtime gathers patterns - when we encounter new information, we use these patterns to recognise situations.

After some time, our mind becomes a self-organising system.

Think about the librarian; they organise the books, sorting and separating the new books into their dedicated categories; but they do not create new categories, they only store new books into pre-made categories.

Our mind is the same, it does not create new patterns when most appropriate, it sorts information into ones that have been made already.

This system is effective and fast, but not optimal.

Let me use an analogy used by the author that is more representative, think of your mind as a large piece of jelly.

New information comes in the form of water, arriving in spoonfuls onto the surface of the jelly.

The first spoonful of hot water creates a shallow depression on the surface. A second spoonful of water is poured nearby and it naturally falls into the previously made depression, making it even deeper - maybe with a small impression left nearby.

Overtime, as you add more and more spoonfuls of water, the jelly becomes a landscape of hollows and ridges.

The jelly has simply provided a memory surface for the spoonfuls of water to organise themselves into patterns. The contours are formed by the water, once formed they then decide where the water will flow

The eventual pattern depends on where the spoonfuls of water were placed and in the sequence with which they were placed. This is the equivalent to the nature of the incoming information into our mind and the sequence of arrival.

Our mind is passive, it is not actively choosing the best ways for new information to be stored and organised, our minds just do it automatically overtime; this works fine, but it is not even close to the best way information can be stored. It is heavily reliant on the order that information enters your brain.

This means that the conclusions we make from situations are highly dependent on the order that things unfold.

Let me give you an example of the dangers of relying on the standard order of information arrival.

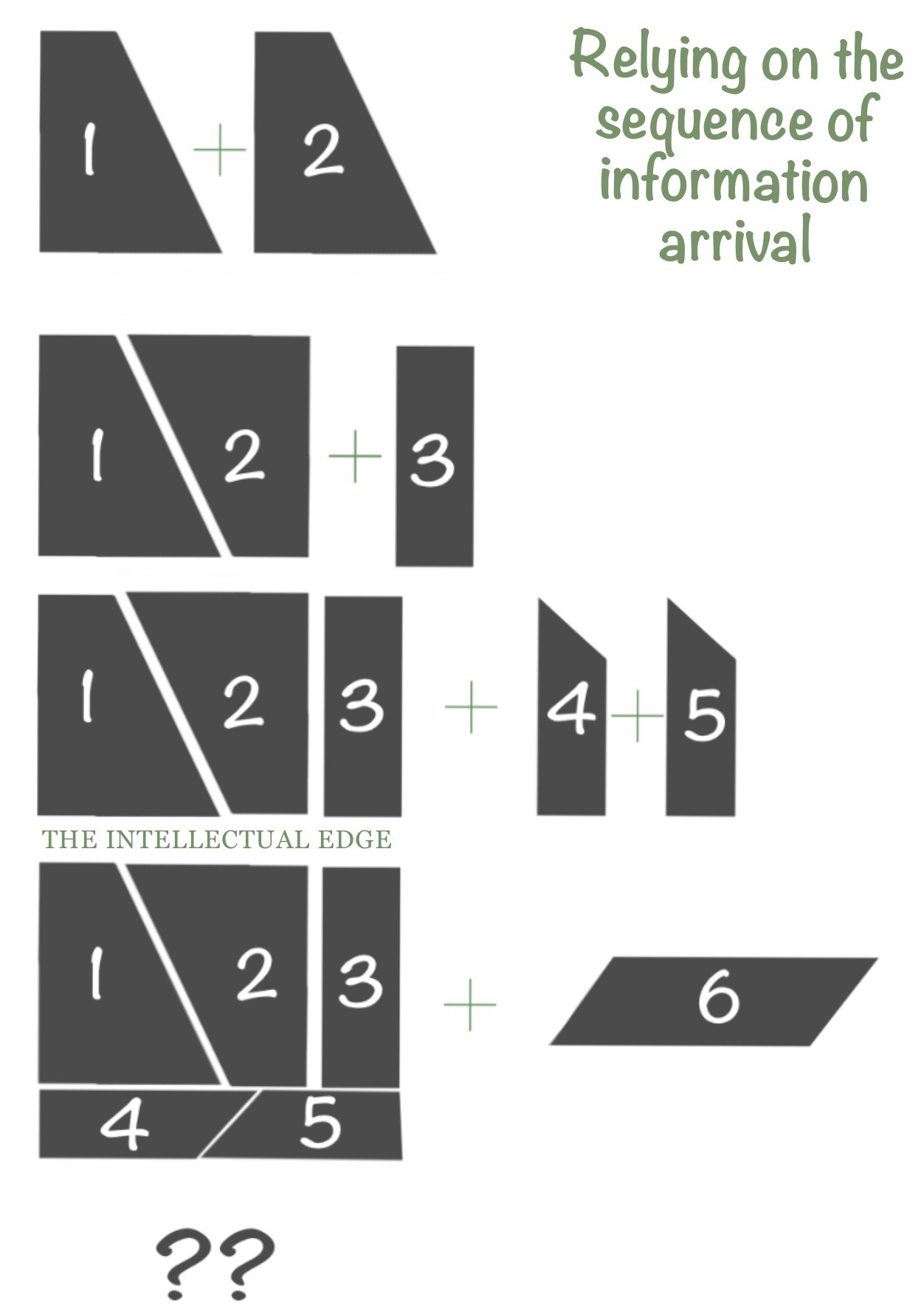

Here are a sequence of shapes, as each arrives, try to think about how you would add it to the previously made shape to create one whole shape again

Eventually, you hit a roadblock, the sequence has stopped functioning, one cannot proceed any further, the new information can not be fitted into the existing pattern and shall hence be disregarded.

Or not?

The image below shows a re-arrangement of the shapes, fitting all pieces together to create one whole shape, this method is much less likely to be tried than the first, despite it being clearly more effective (this is because it takes more energy which our lazy brain doesn’t like).

De Bono says that “There comes a time when one cannot proceed further without restructuring the pattern - without breaking up the old pattern which has been so useful in and arranging the old information in a new way.” He goes on to say “The sequence of arrival on information determines the way it is to be arranged. For this reason the arrangement of information is always less than the best possible arrangement, for the best possible arrangement would be quite independent of the sequence of arrival of the pieces of information”

So, how can we negate this sub-optimal process within our mind?

By the process of lateral thinking.

The Two Main Processes: Lateral Thinking & Vertical thinking

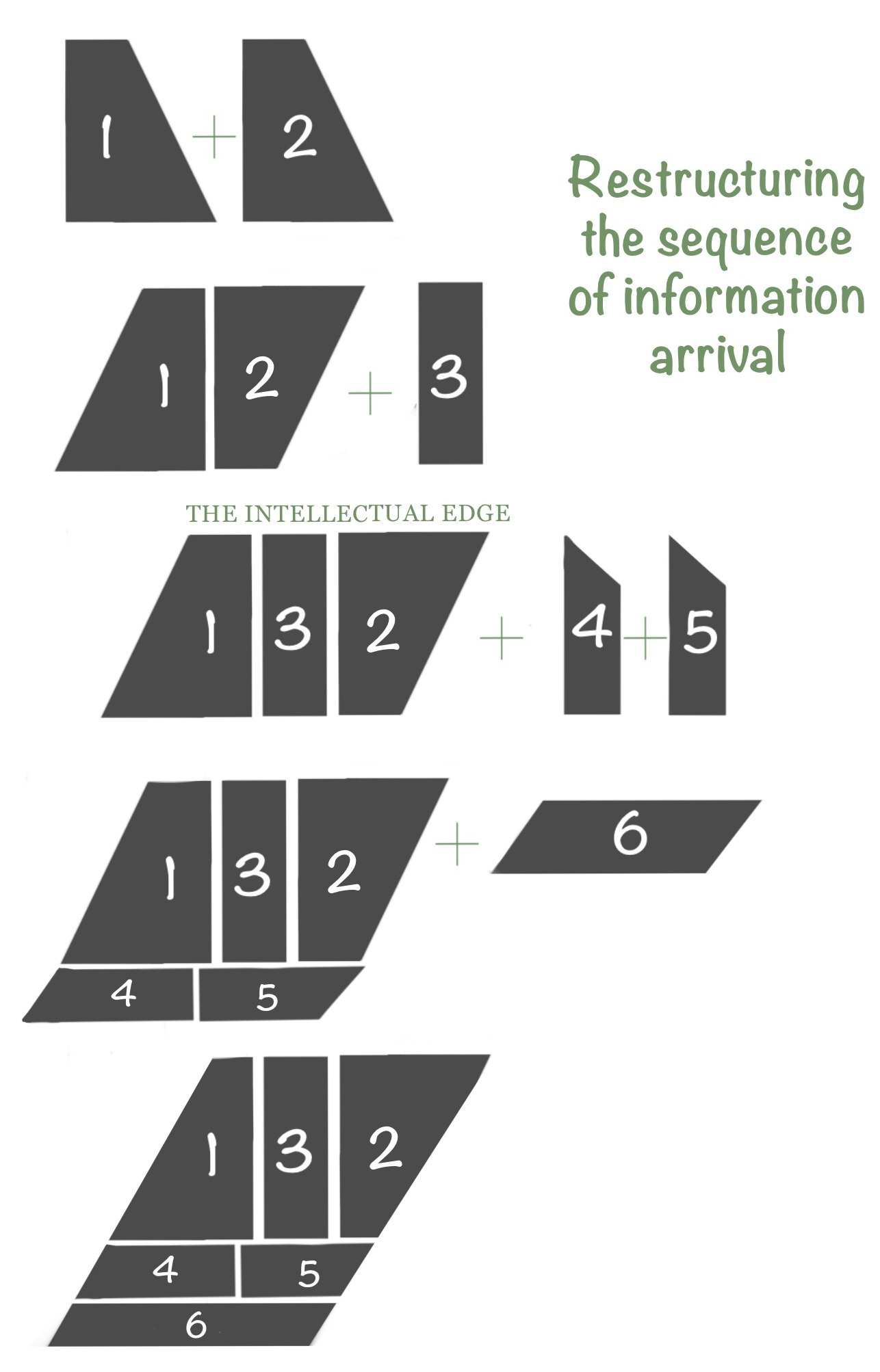

There is two main ways of thinking according to De Bono, there is vertical thinking, which is a picky, logical, selective process. Then there is lateral thinking, a non-judgmental, generative process.

With lateral thinking, it is a process that seeks to approach problems and situations by generating as many solutions as possible, with vertical thinking, it is about generating solutions until you find one that works.

I will visualise the difference between the two below.

The green bars below represent solutions, and the blue line represents the required depth for a problem to be solved.

Vertical thinking stops when it reaches a sufficient answer.

Lateral thinking continues despite an answer being found because it may not be the best answer; after generating multiple ideas you can then pick the best solution from a larger pool.

These minor improvements in decision making add up over a lifetime.

This example is black and white, real life is of course not black and white.

Vertical & lateral thinking are not enemies, they are friends, they are most effective when used together.

After thinking laterally, one should think vertically to progress and develop one’s solution.

The relationship between vertical & lateral thinking is shown in human evolution, consider the idea of the progression of human movement:

Vertical Thinking: Crawl → walk → jog → sprint → what next, I can not move any faster?

Lateral Thinking: I have an idea, horses.

Vertical Thinking: Okay, horses → whips → saddles → carriages → what next, I can not move any faster?

Lateral Thinking: I have an idea, trains.

You get the idea, lateral thinking innovates, and vertical thinking develops. Vertical thinking multiplies the effectiveness of lateral thinking by making good use of the ideas generated.

Now you understand the foundations, let’s discuss how to do it.

How can I practise Lateral Thinking?

We now know what it is, but how on earth do we do it?

I will run you through three quick and effective methods to begin lateral thinking. I have two episodes that go into other methods in great detail, here and here.

Three methods to effectively think laterally:

Challenging Assumptions

It is historical continuity that maintains most assumptions, not a repeated assessment of their validity.

In problem solving, one always assumes certain boundaries, these boundaries are usually self-imposed, and tarnish the overall effectiveness of the chosen solution.

If the boundaries you put up for yourself in solving a problem are wrong, then it may be impossible to solve the problem at all.

It is vitally important to challenge all previous assumptions when approaching a situation, this way you break down any beliefs that are falsely held.

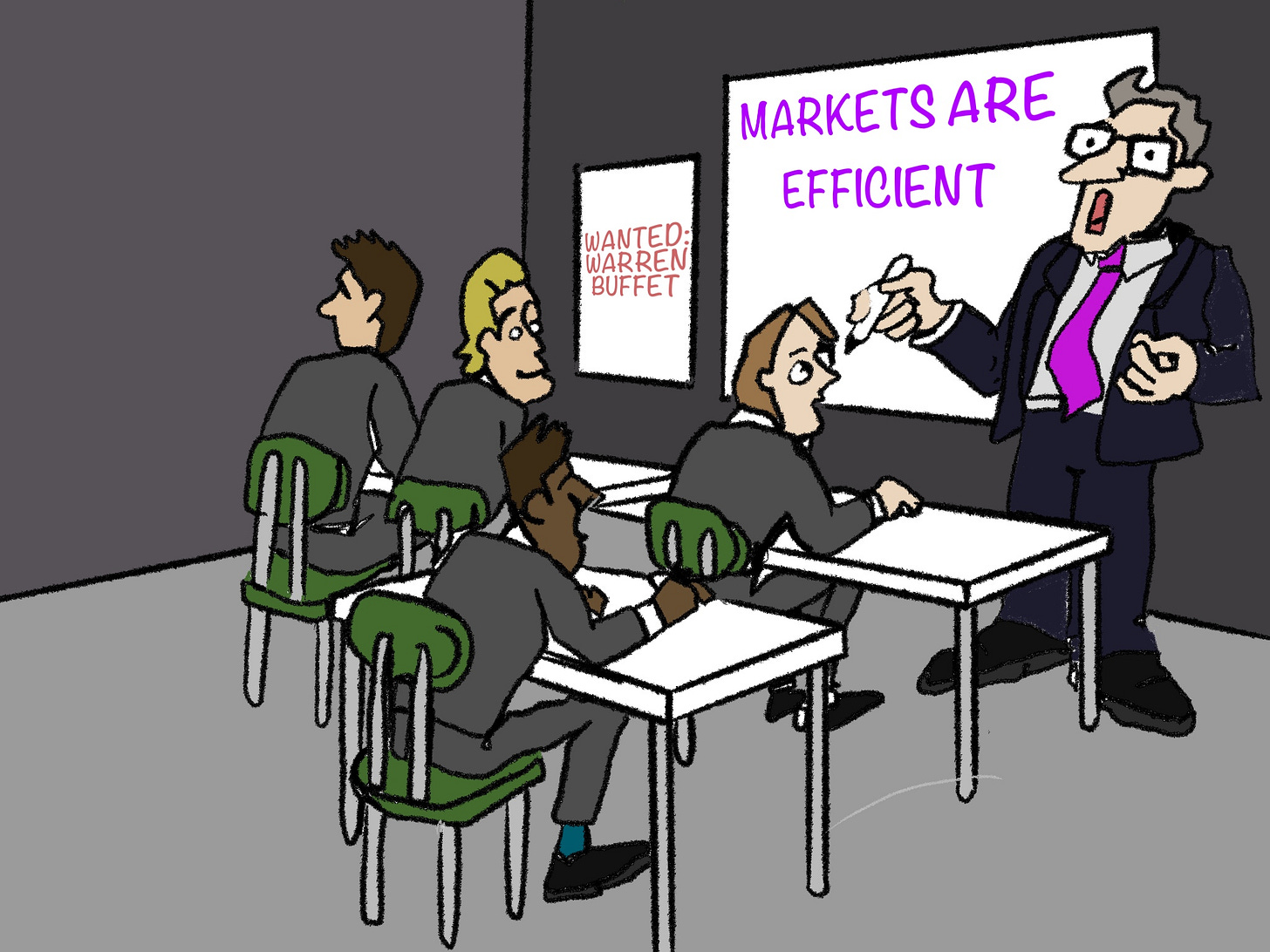

In markets, challenging assumptions is absolutely vital, consider this example:

Efficient market theory was a major assumption in 20th century economics, those who accepted that assumption missed out on major opportunity, those who denied that assumption were rewarded handsomely.

Think of these guys:

Warren Buffett

Howard Marks

Charlie Munger

Joel Greenblatt

George Soros

If they hadn’t challenged assumptions, we wouldn’t even know their names.

Another example is the valuation of tech companies; with standard assumptions, valuations for them are outrageous - it took breaking a major assumption regarding valuation to include the value of intangible assets.

The reward for a challenged assumption outweighs the effort it to takes to challenge it.

Suspended Judgement

The need to be right all the time is the biggest bar there is to new ideas. Judgement is the killer of some amazing ideas that were yet to be fully developed. The human race has an insatiable desire to be right all the time, which means we wrongly dismiss incorrect ideas, even though they may lead you to correct solutions in the end.

The dangers of being right all the time are as follows:

Arrogant certainty attends a line of thought which though correct in itself may have started from wrong premises

An incorrect idea which would have led on to a correct idea is choked off at too early a stage.

The importance attached to being right all the time breeds the inhibiting fear of making mistakes

The purpose of thinking is not to be right, but to be effective. Being effective involves eventually being right but there is a very important difference between the two. Being right means being right all time. Being effective means being right only at the end.

In suspending judgement, you do not shut down a thought process simply because it is wrong, you explore it in spite of its wrongness in the hope of it leading somewhere fruitful.

Lateral thinking allows you to be wrong along the way even though one must be right at the end.

Let me give you a historical scenario where suspended judgement would have saved the day:

Long Term Capital Management was a hedge fund founded in 1994 run by brilliant economists and Nobel Prize winners who used complex mathematical models to exploit small inefficiencies in global markets.

Their strategies were highly leveraged, meaning they borrowed massive amounts of money to amplify their returns.

They relied on historical data and normal distributions, assuming that rare events (like huge market moves) were virtually impossible. In their models, a 5-standard-deviation event was once in the history of the universe kind of rare.

They dismissed the possibility of extreme volatility.

Instead of judging alternative possibilities as too unlikely and ignoring them, they could have suspended their judgment about rare events and asked:

What if the market correlations we rely on suddenly break?

What if every institution is on the same side of the same trade?

What if a Russian debt default does trigger a global liquidity crisis?

These are questions that didn't fit the model, and were therefore dismissed prematurely.

But if they had held off on immediately labeling these ideas as unlikely or irrational, they may have reassessed their risk exposure, reduced leverage, and ultimately they would have survived the crisis.

If they had explored further the scenarios they deemed as impossible, they would have come eventually to a correct answer; being that the seemingly impossible was very much possible.

Suspending judgement allows you to explore scenarios that seem wrong because it may lead you to a conclusion that is right.

When you next ignore a solution because it is wrong, explore it a little further; you never know what might come of it.

The Reversal Method

The reversal method involves flipping situations, if you’re currently looking at Trump’s tariff’s and responding with fear and worry, the reversal method would tell you to flip the story.

Why are the tariff’s good? Who benefits? Why should I be happy that this is happening?

In the reversal method, one takes things as they are and then turns them round, inside out, upside down, and back to front. By disrupting the original way of looking at the situation one frees information that can now come together in a new way.

Consider this example:

In standard economics, unemployment is seen as a major problem; linked to poverty, reduced spending, and social instability. But what if we reverse the assumption? Instead of “Unemployment is bad” we ask “What if unemployment is actually a good thing?”

In flipping the narrative, you may uncover brand new insights such as:

Exploration of Universal Basic Income: If people don’t need to work to survive, can we restructure productivity and redefine value creation in society?

Automation optimism: If machines replace jobs, perhaps that’s an opportunity to reallocate human energy to creativity, education, care, and innovation.

New economic structures: Encourages models that decouple self-worth from employment, potentially leading to healthier, more fulfilled lives.

Hidden costs of employment: Maybe we overlook the stress, environmental impact, and inefficiencies of forcing full employment.

By reversing the standard assumption you can start to bring together new insights that would have been ignored in standard thinking.

By breaking down old information patterns you liberate insight, by restructuring information you generate new insight.

It is a liberating realisation, the ability to become infinitly smarter without even taking on new information, it is merely dealing better with the information you already have.

How Lateral Thinking Can Improve Your Performance:

Investing is an art, not a science, correct answers suit black and white fields such as physics, economics is not black and white, it requires nuance, it requires more than correct answers, it requires deep thought about scenarios that you didn’t even deem possible (particularly relevant among the current Trump tariff’s).

Being an art, this suggests we need more than mathematics to be successful, we do.

We need to think different, act different, analyse different, invest different; which is why lateral thinking is so vital.

Here are 3 reasons why lateral thinking will improve your performance.

1. Problem Solving

Vertical thinking tries to solve problems with conventional methods and step-by-step logic.

But investing and business rarely follow a neat formula. Look at today’s market & Trumps tariff’s; Markets change, narratives break, and assumptions get shattered (surprisingly fast, and surprisingly easily)

Lateral thinking, by contrast, grants you the ability to analyse uncertain situations with far better contingencies in place, I say contingency because it does not grant accurate prediction, it grants awareness of outcomes, which allows you to create contingencies, and protection from risk is just as valuable as exposure to reward. Lateral thinking forces you to reframe the problem altogether, you see angles others miss. You stop asking: “How do I fix this?” And start asking: “Is this even the right problem to solve?”

This is how you spot the hidden risk, the mispriced opportunity. It’s how you look at a company and think not “what’s the revenue growth?” but “what hidden asset isn’t being valued?”

Legendary investors win not by having better data, but by asking better questions and solving problems better than anyone else.

2. Mastery in Nuance

Lateral thinking rejects logic. Instead, it trains your mind to sit with complexity. It’s the difference between seeing a bad earnings report and panicking versus understanding that context is everything: macro conditions, customer behavior, pricing power, and even narrative cycles. It allows you to see past the numbers and understand the real goings on of a business.

Most investors analyse the surface-level and base investment decisions from it, why then, do we question how markets remain irrational? It is a collection of irrational thinkers.

Linear thinkers crave clarity and order. Lateral thinkers get comfortable with complexity and learn to extract insight from chaos.

Lateral thinking is the pair of binoculars that allow you to see clearer, and further, than anyone else

Understanding the nuances that move markets allows you to extract value from them.

This understanding lets you:

See the subtleties behind a stock’s movement.

Detect the psychological patterns in market movements.

Understand that what looks like a weakness might actually be a long-term strength.

When you think laterally you stop being reactive, you become a seeker, you question, you prod and poke, you analyse beyond the surface, you become skeptical, you seek truth, relentlessly; lateral thinking is a superpower, use it.

3. From Sufficiency to Optimization

Most investors stop once something seems to work, but sufficiency is the enemy of greatness.

If you want to know how sufficiency is limiting you (it is - in ways you wouldn’t believe), then click here.

Lateral thinkers go beyond sufficiency, they relentlessly dig for more.

They ask:

“What have I taken for granted?”

“What’s the consequence of the consequence?”

Lateral thinking is how you move beyond:

Using a valuation model → to rethinking the assumptions behind valuation itself.

Accepting industry norms → to designing business models that change the game.

It’s the difference between:

“How do I beat you at this game?” and “Why don’t I play a different game from you altogether?”

“Forward returns in stocks are low, I’m going to have to improve my stock-picking ability!” and “Where else can I invest? Wine, Watches, Art, Credit, Private Equity…?”

This is second-level thinking, as Howard Marks would put it.

It lets you question and optimise in places others don’t even know existed.

Not convinced?

I will leave you with a couple of examples of famous investors & entrepreneurs displaying lateral thinking,

If it’s something most commonly used by the most successful people, I think we should probably start to take notes:

Micheal Burry in 2005:

Everyone saw the housing market booming. Burry asked: What if the boom is fake? Everyone saw AAA ratings. Burry asked: What’s really inside these CDOs?

While the world was partying in real estate, Burry was reading the footnotes. He didn’t just look at what others were looking at, he looked through it.

That’s lateral thinking: changing the frame, not the object.

Warren Buffett (All the time):

Buffett has clearly shown his performance is not down to chance. His entire process is steeped in lateral thought. While others diversify, he concentrates. Whilst everyone’s selling, he’s buying. His entire mind operates on the second-level.

While Wall Street worships quarterly earnings, he builds for decades.

Buffett’s success requires lateral thought beyond comprehension for us mere mortals.

Buffett plays a completely different game because he’s asking completely different questions.

Jeff Bezos - Reframing Retail:

In the 90’s, most companies said “We’ve got stores. That’s enough.”

Bezos asked a different question: “What if the store came to you?”

Amazon wasn’t just an online store, it was a re-imagination of infrastructure.

While competitors focused on products, Bezos focused on distribution.

While they scaled inventory, he scaled convenience.

Amazon was born through lateral thought.

Lateral thinking is innovation.

Lateral thinking is contrarianism.

Lateral thinking is your unfair advantage.

The opportunity cost of not thinking laterally is unfathomable.

Question assumptions, suspend judgement, reverse situations, do everything you can to separate your thinking from everyone else’s.

Acting independent from the crowd begins with thinking independent from the crowd, lateral thinking is your edge.

Thank you for reading, I hope you enjoyed this episode!

Sincerely,

The Intellectual Edge