The Uncommon Sense of Analogies

How filling a bath tub can make you a better investor...

Hello!

I have stumbled across something that has revolutionised my thinking, and I think it could do the same for you.

In reading lateral thinking, a book by Edward De Bono, I have learned about the use of analogies in generating new insights.

What is Lateral Thinking?

Lateral thinking is a process by which you generate insights through the restructuring of current information; in doing so, you break out of the conceptual prison of old ideas.

It is to look at something in a different way that has always been looked at in the same way.

In lateral thinking, you can not be wrong, it is only concerned with thinking broadly about a way of doing or a way solving something.

Here’s a problem, say, I run out of milk, what should I do?

The immediate answer would be to buy more milk.

But lateral thinking doesn’t stop there, you keep going in spite of a potentially correct answer, in thinking laterally there is no wrong answers, it is the intentional generation of new possibilities no matter how abstract. You might solve the problem by saying:

Buy more milk with each shop you do, this way you don’t run out so fast

Buy a cow so you never run out again

Quit drinking milk altogether

Borrow someone else’s milk

Ask a family member to pick some up for you

Have a standing order from a milkman

Reduce your milk intake so you run out less frequently

There is no wrong answer in lateral thinking, it forces you to think of alternatives, it forces you not to go down the route your mind instinctively wants you to.

To begin with, lateral thinking feels trivial; it feels like a waste of time, it feels silly.

Once you acquire a genuine insight from it, you will wonder how you have come so far in life without it.

Lateral Thinking Using Analogies

One method of thinking laterally is the use of analogies. This method struck me so hard that I feel It deserves its own post.

As with any other form of lateral thinking, you do not start once you can see where you’re going to go with it, you start for the sake of starting and see where it takes you.

In lateral thinking, analogy’s are not used to prove anything, they are used as mental stimulation.

De Bono states we must take an analogy and restructure it, we then transfer the restructured analogy back to the situation and analyse how that situation may now be looked at differently.

The analogy and the analogised shouldn’t be easily linked, it is in their randomness which the most wonderful and original insight is born.

Here’s an example:

Analogy: Exercising in the morning

Situation: Running a small company

Insight: Exercising first thing in the morning gets it out of the way so you can do as you please for the rest of your day - In running a small company, the first thing in your to-do list should be the thing you want to do least, get the bad jobs out of the way immediately.

Insight: Exercising releases positive hormones that set you up for a good day - In business, do something good for your employees first thing in the morning, this way they have a positive experience earlier and hence work more enjoyably for longer and hence productively for longer.

Insight: Exercising early allows you to see the beauty of a sunrise - In business, do hard things that take extra effort, they will most likely come with rewards that make it more than worth it.

Insight: Exercising early prioritises health over anything else - In business, nothing matters more than the health of your company, if your first priority is not to be net cash with consistent cash flow generation, you may be setting yourself up for an early demise.

See how one randomly assigned analogy can generate useful insight into an entirely unrelated situation? We did not even fully restructure the analogy, and we found so much insight from it.

The key is to restructure the analogy without knowing how it will impact the situation, choose a random restructuring and force yourself to find a way to link it - this is how insight is born.

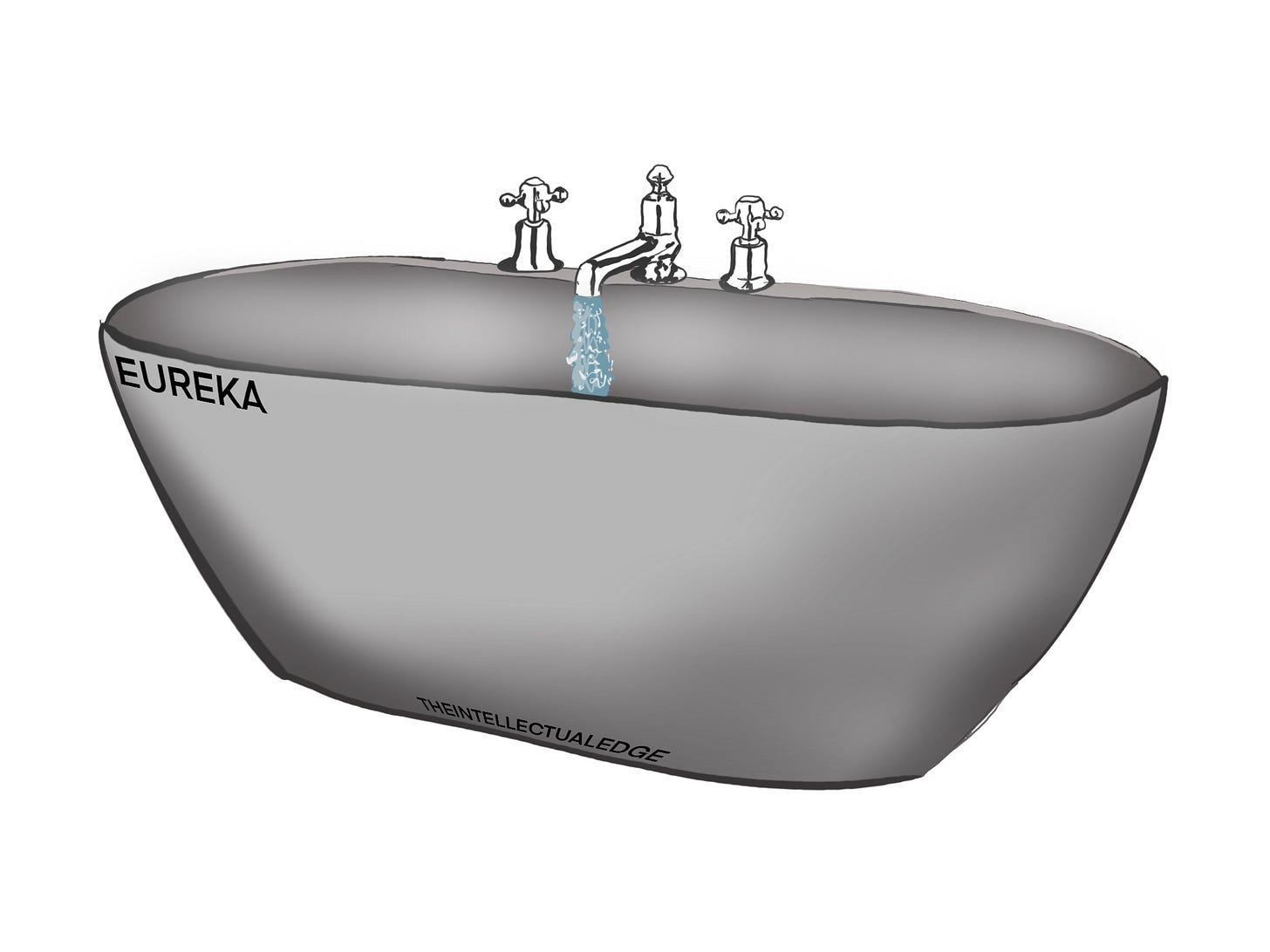

Lateral Thinking With Analogies: A Bath Tub & Value Investing

In the book, he offers one analogy of filling up a bath tub.

Let’s practice one more time, this time generating insights specifically into stock market investment via the restructuring of the analogy ‘filling up a bath tub’.

Restructured: The bath tub overflows.

Insight: You can have too much of a good thing, if you invest with leverage for example, too much will cause more damage than it is worth. If you overexpose to a certain position, it can backfire and damage returns. The damage from over exposure can be irreversible.

Restructured: The bath tub is only filled 5cm high.

Insight: Being too conservative will ensure that bad outcomes never materialise, it also means you will not expose yourself to returns at all, if you require too large a margin of safety, you will not reap the rewards of your diligence.

Restructured: The bath is dirty prior to filling.

Insight: When performing valuation analysis, if you have prejudices, incorrect assumptions, or poorly constructed predictions, no matter how smart your calculations, you will end with a poor valuation, your assumptions must be unbiased and conservative in order for the final valuation to make sense.

Restructured: You add hot and cold water as well as salts, soap, and shampoo.

Insight: There is no golden number, no one figure that a company is worth, it works in ranges, it is better to be approximately right than precisely wrong. Have a range of assumptions to best capture the inevitable uncertainty that will unfold. You may need to approach valuation from a different perspective, a business with valuable intangeables may come across as far more expensive than it way truly be, nothing is black and white, a nuanced approach to everything is necessary.

Restructured: The bath is moved to the living room.

Insight: Just as you wouldn’t take a bath in the kitchen, you shouldn’t invest in places that your intelligence does not belong, your circle of competence is your guard against unnecessary stupidity.

Restructured: The temperature gets too cold.

Insight: Nothing remains, there is no permanence, things change constantly and we must periodically re-evaluate positions, valuations, sentiment, etc.. in order to successfully invest over a lifetime.

Restructured: You gradually step in to the bath.

Insight: Just as you do not jump into the bath at once, you should not jump fully into an entire position, you should step into it gradually, enter positions in a way that protects you from unlikely events taking place and harming your returns.

This one analogy, restructured creatively, when re-applied to the situation of investing, becomes a fruitful harvest of fascinating insight.

It is amazing; the number of insights available to generate are only limited by your imagination.

Here’s a few analogies you can use to practice if you so please:

Frying potatoes

Serving in tennis

Listening to your favourite song

Drinking coffee

Washing dishes

Running from the police

Try and link these analogies to situations in your life.

Does drinking coffee relate to leverage in business? Does listening to your favourite song equate to the joys of client loyalty? Does frying potato show that there is more than one way to approach investing?

Think big, think wide, no answer is wrong. It is about insight generation.

As I said, it may seem trivial, but to effectively use analogous thinking, you must have an open mind, you must allow thoughts that seem wrong to enter your mind and let them play out in their entirety.

It is a treasure trove of insight if used correctly.

Let me know if you find any valuable insights from this unique way of approaching problems and situations.

Thank you for reading!

Sincerely,

The Intellectual Edge