The Latticework of Mental Models: A Comprehensive Guide

This concept will change your life.

This is one of the most important concepts I’ve ever come across.

This is a comprehensive guide to building what Charlie Munger called his ‘Latticework of mental models’.

If you’re thinking ‘what is it and what does it have to do with investing?’.

Don’t worry, I assure you two things: it’s a simple concept, and it has everything to do with investing.

Successful investing boils down to good judgement; you’re not paid on how long it takes you to analyse the business, you’re paid if you’re right.

And you can’t expect to have good judgement with limited knowledge, you’ll just be forcing reality to fit a distorted view of the world.

That’s a recipe for disaster.

If we’re to prevent this disaster, we need mental models.

A mental model is a concept that explains how the world works, think natural selection from Biology, critical mass from Physics, margin of safety from Engineering, and so on.

These are fundamental truths that help us navigate our complex world.

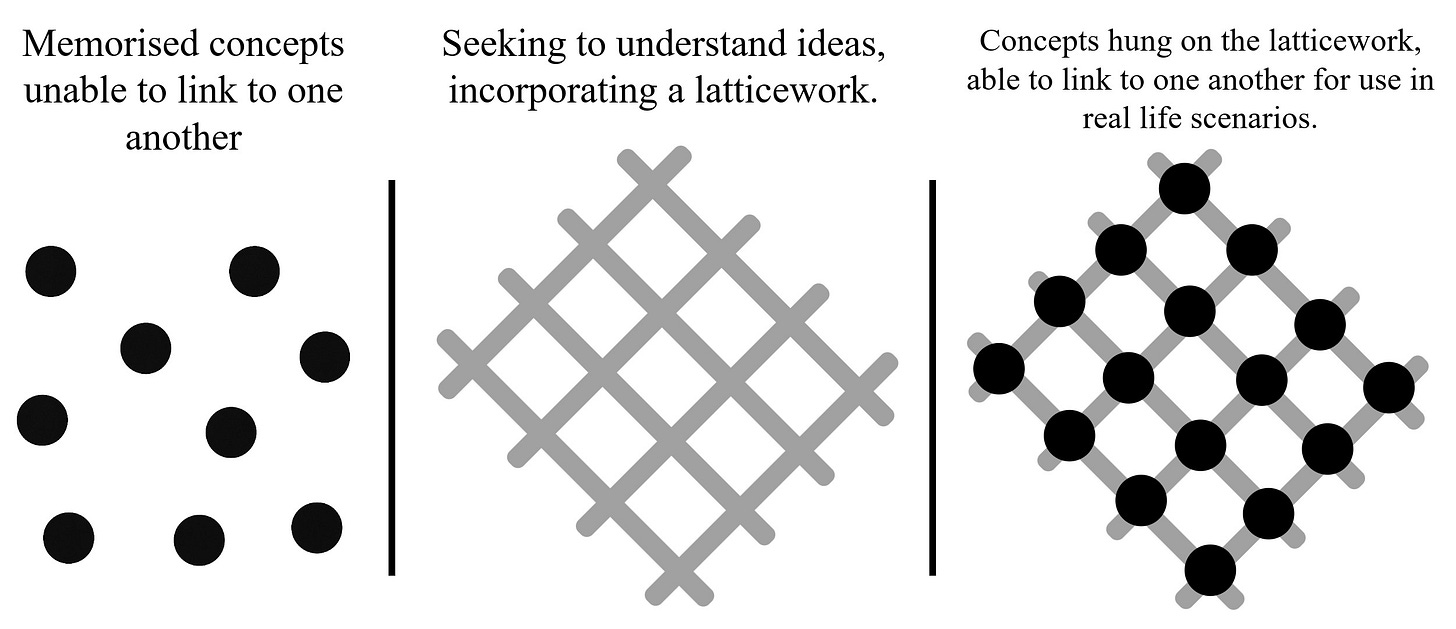

To think effectively, we need to understand these mental models and hang them on a latticework of theory, along with our experiences (vicarious & direct).

By hanging these ideas and experiences on a latticework of theory, they become interconnected and we can then begin to apply them into various aspects of our decision making.

Memorising these concepts isn’t enough, understanding them is where the magic lies.

When organised, these mental models lead to remarkable insights.

The following is paraphrased from the book Poor Charlie’s Almanack:

For us investors, the models supply the analytical structure that help to reduce the chaos and confusion of a complex investment problem into a clear set of fundamentals.

The result of this broad-spectrum analysis is a heightened understanding of how the many factors affecting an investment candidate blend and link to one another.

Mungers approach accepts the reality that investment problems are inherently complex, and in a manner more in keeping with the rigors of scientific inquiry than conventional investing, he attacks them with a staggering degree of preparation and broad-based research.

Charlie strives to reduce complex situations to their most basic, unemotional fundamentals. Yet, within this pursuit of rationality and simplicity, he is careful to avoid what he calls physics envy, the common human craving to reduce enormously complex systems (such as those in economics) to one-size-fits-all Newtonian formulas.

Instead, he faithfully honors Albert Einstein’s admonition: “A scientific theory should be as simple as possible, but no simpler.” Or, in his own words: “What I’m against is being very confident and feeling that you know, for sure, that your particular action will do more good than harm. You’re dealing with highly complex systems wherein everything is interacting with everything else.”

Munger correctly stated that we must have many models: “if you have just one or two that you’re using, the nature of human psychology is such that you’ll torture reality so that it fits your models, or at least you’ll think it does.”

Certain situations need certain models: the more models you have, the more effectively you’ll be able to apply them.

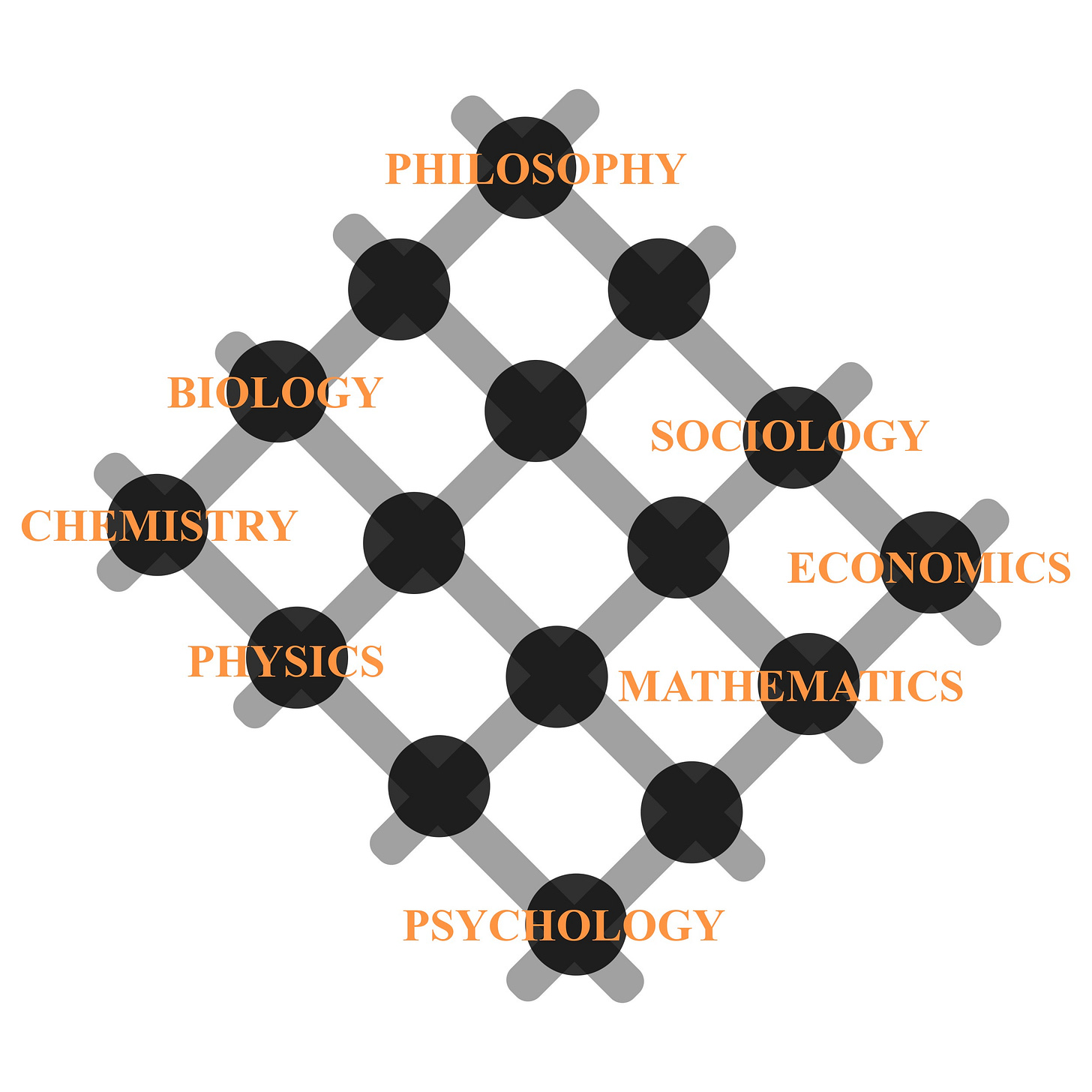

This means you’ve got to have models across an array of disciplines; all the wisdom of the world isn’t found in one academic department of course.

Here’s Munger explaining this approach - you must listen to this.

Your latticework will be diverse, full of multidisciplinary ideas.

You’re probably thinking “This is far too complex, I just wanted to pick stocks!”.

There’s three reasons for you to stick with this today:

This will be where most people give up. Don’t be like most people.

You’ll see that it’s extremely simple provided you have a good plan and a long term view.

The benefits it’ll bring to your life & investments can’t be overstated. Munger is the only evidence you need of this; loved by all, and wildly rich.

As I mentioned in a recent piece on contrarian investing, uncommon rewards are reserved for those that do uncommon things.

If you want to achieve success in investing, you have to do something different from the crowd.

This is one of those ways you can separate yourself. If you’re willing to begin building your own latticework here today, you’ll start the journey of differentiating yourself from the crowd.

Today’s article includes a PDF that shows you exactly what these models are and where to understand them effectively.

This document has taken a very long time to put together. It’ll be the foundation for you to build your latticework on.

Let’s dive into it.

The Guide To Building A Latticework of Mental Models

The full guide is in a PDF format, I did it this way so you can save it to your device and access it easily, forever.

No need to indefinitely keep your Substack open in case you want to check out a new idea…

In this PDF, you’ll find:

Over 150 of the key mental models across the disciplines

The best Resources available online to learn them, including videos, books, podcasts, and websites.

I put many (many) hours of blood, sweat, and tears into creating this document, I hope it is a good companion to you, as I’m sure it will be to me.

I think this document is worth the subscription alone.

Download it below: