The Case For Multi-disciplinary Thinking

The best Intellectual Edge we can have.

If you don’t think with a multi-disciplinary perspective, you’ll live in the shallows of life.

The most talented individuals to walk this earth - Leonardo Da Vinci, Michelangelo, Benjamin Franklin, Isaac Newton - were all multi-disciplinary thinkers.

They understood that the world was not meant to be neatly separated into separate disciplines.

It’s easy to forget that in reality there’s no difference between psychology, economics, sociology, or physics; we separate them to make sense of them and to learn about them.

That’s just something we humans have done in order to make sense of the world.

But in real life these subjects aren’t separate; they’re all linked and they have the ability to transform your thinking.

Brilliant thinker and investor Charlie Munger (Buffett’s right hand man) continuously preached that we need to understand the fundamental ideas from all the disciplines and weave them together to create insights that’ll improve our investing (and life).

This was what Charlie Munger would call having a latticework of mental models.

If I were to have only one insight from all of my learning so far in investing - it‘d be the latticework of mental models.

In one of Munger’s famous speeches, he explains the benefits of this multi-disciplinary approach.

You have to check this out:

This latticework that Munger speaks of is like a database in our mind where we can automatically and effectively cross-pollenate our ideas.

The benefits of this latticework are mesmerising.

Consider this example, where knowledge of one idea from biology can improve your investing:

Let’s say one stock in your portfolio is flying and one is falling; naturally, you’ll be inclined to sell some of your winner to buy more of the falling stock.

However, biology and the theory of natural selection would suggest you add capital to the winner.

If you had two cars available for a race - one has won every time you raced with it, the other has lost every time you raced with it - would you sell your good car to try and improve your bad car? Or would you go all in on your winning car?

This is natural selection, and it’s no different in investing.

This big idea has made its way to investing through the form of a catchy quote that you likely know very well:

“Selling your winners and holding your losers is like cutting the flowers and watering the weeds.” - Peter Lynch

This quote typifies natural selection.

Everywhere else in life we go with the flow of natural selection, but here in the stock market we see it happening in our portfolios and feel the urge to go against it.

It’s irrational. But having your own latticework will save you from mistakes like watering the weeds.

If knowledge of natural selection can revolutionise your skill in portfolio construction, think about how boundless the opportunities to become a better investor are from understanding the other big ideas.

Once you think this way, you’ll suddenly notice that most successful people think this way too.

Jim Simons, founder of the Medallion Fund & Renaissance Technologies (which has returned 66% annually over 30 years, turning £1 invested into £235,000, before fees), has been one of the best performing investors the world has ever seen.

How did he achieve this performance? A team of enthusiastic analysts charging forward on his behalf?

No. He hired a team of mathematicians, engineers, and scientists.

He knew how important multi-disciplinary thinking was.

The improvements in investing that come from an eclectic knowledge base cannot be overstated.

If I haven’t fully persuaded you, here’s Morgan Housel, author of The Psychology of Money, to give you a little extra nudge:

Multi-disciplinarian Thinking In Action

I recently re-read one of my favourite books of all time, Investing: The Last Liberal Art, by Robert Hagstrom.

It’s a brilliant springboard for someone looking to get into this way of thinking; packed with insight, reading lists, and various fascinating topics, it’s absolutely worth your time to read.

It’ll open your eyes to the wonders of multi-disciplinary thinking.

Through the lens of social science, I’m going to show you how multi-dsiciplinary thought can impact your investing.

Lots of the following are gathered from Hagstrom’s work - if you enjoy this letter - you’ll love the book.

Social Sciences and The Ant Colony

Social science deals with human behaviour in its social and cultural aspects.

Included within the social sciences are anthropology, sociology, psychology, political science, and economics.

In recent times, social scientists have begun the study of entire systems - not only the behaviour of individuals and groups but the interactions between them and the ways behaviour is subsequently impacted.

These whole systems are commonly referred to as complex adaptive systems.

This video defines complex adaptive systems:

Economies and stock markets are complex (composed of many elements) adapative (their behaviour constantly changes as investors interact) systems.

Through the study of other complex adaptive systems, we can gain insight into the functioning of specific systems like the stock market.

A key component of a complex adaptive system is what is known as the theory of emergence. This is the way individual units combine to create something greater than the sum of the parts.

For example, many individuals seeking satisfaction of their own needs engage in buying and selling with other individuals, creating an emergent structure called a market.

Hence the behaviour of the collective system creates an emergent property that transcends its individual units.

There isn’t a central controller in these systems, they’re self-organised.

For example, if you move to a new town you’ll move to the area that suits you best, be that through similar culture, interests etc… This is a self-organised system.

Self-organised systems have three distinct characteristics.

The first: complex global behaviour occurs by simple connected local processors (us).

The Second: A solution arises from the diversity of the individual inputs.

The Third: The functionality of the system is far greater than any one of the individual processors.

This reminds me of open source software development. It encourages more individuals to take part, speeding up the problem solving process thanks to a higher number of individual inputs.

Whilst my knowledge of cryptocurrency is limited, I do try to understand its fundamental ideas; an individual miner could not keep up with the amount of transactions on Bitcoins blockchain, deeming it worthless; but all of the individual miners working together on the blockchain creates an extremely valuable and trustworthy system.

When you look for the similarities, they’re easy to see.

Going back to the theory of emergence, let’s look into another social system and how it might impact our investing:

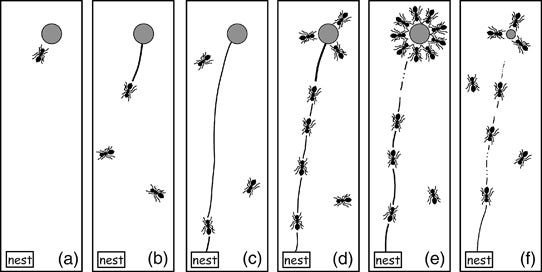

The ant colony.

This section is going to feel like a far cry from our world of numbers, ratios, and annual reports, but do stick with me - it’s worth it.

Since ants are social insects, social scientists are fascinated by their decision making processes.

One of the most interesting behaviours among ants is the process of foraging for food and determining the shortest path from the food to the nest.

When going from food to nest, ants leave behind a pheromone trail that allows them to retrace the path, as well as showing other ants the location of the food.

To begin with, the search for food is random, ants start in different locations. Once they find food, they return to the nest - laying down a pheromone trail as they go.

Now comes the genius of the collective, ants are able to quickly and effectively find the shortest route to that food. If one ant happens to find a faster way back to the nest from the food, the concentration of the pheromone path is more intense.

Other ants then tend to choose the most concentrated path, hence being led down a new and shorter path. The more ants on this path further increases the strength of the pheromone trail, further attracting more until it becomes the preferred trail.

Put simply, this optimal solution is an emergent property of the collective behaviour of the colony.

The key characteristic necessary in producing emergent behaviour is diversity.

The collective solution is only robust if the individual contributions to the solution represent a broad diversity of experience in the problem at hand.

Research has shown that actually having only high performing people degrades the entire system.

This appears to prove the requirement of a diverse collective in better adapting to unexpected changes.

A situation that might prove this has sprung to mind: Long Term Capital Management (LTCM)

LTCM was a hedge fund in the 90’s made up of extremely talented individuals, famous traders and Nobel-prize winners; long story short - it blew up.

Everyone backed the team of high performers, and it failed miserably.

Let’s tie this together and bring it all back to the stock market.

This theory suggests the market is better off for having investors of low, average, and high intelligence - compared to a market full of those with high intelligence.

As Hagstrom says in the book, this may seem a counter-intuitive conclusion.

We are quick to blame the amateur investor and trader for the volatile nature of the market, but this suggests the market is stronger for the inclusion of these individuals - smart and dumb alike.

And history supports this thesis.

Booms and busts existed long before people heard of day trading; institutional investors caused havoc long before individual investors became active in the system.

The entire Great Financial Crisis was caused by the inventions of smart individuals; think about CDO’s, Synthetic CDO’s, an incentive scheme that rewarded number of mortgages given - regardless of the quality of the prospective buyer, ratings agencies scared to lose business, the list goes on…

I’m reminded of this scene from The Big Short, where Steve Carell’s character does a little scuttlebutt research by talking to some mortgage brokers…

Maybe a more diverse range of individuals within the financial system would have prevented such situations from occuring.

A system full of engineers, mathematicians, scientists, etc… would create a much more robust & effective financial market.

This has been successfully proven by Jim Simons at Renaissance Technologies.

Knowing about emergent properties and what makes a robust social system can be useful in constructing portfolios, hiring staff in business, government, how you intend to structure your friendship circle etc…

These are insights that can have a powerful impact in both your professional and personal life, all from researching social science and the behaviour of ant colonies…

This is what multi-disciplinary thinking does, it’s a fantastic way to generate genuinely useful, timeless insights.

An idea that applies in multiple disciplines is more likely to be resilient, and more likely to serve you for a lifetime.

If this brief discussion has benefited your thinking, think about the plethora of ideas we haven’t discussed.

Think about just how much there is yet to learn that can catapult the quality of your decision making. I personally find this very exciting.

In Hagstrom’s book, he covers Biology to Physics, Psychology to Philosophy, and so much more. It’s the perfect base for you to begin your own latticework.

Multi-disciplinary thinking has been the most important insight I’ve ever come across.

However, it does come with one caveat:

The Rewards Await Those Who Genuinely Seek Understanding

The benefits of multi-disciplinary thinking are reserved only for those willing to genuinely understand ideas, if you try to arbitrarily learn an idea from Biology and expect your returns to benefit the next day - you’ll quickly realise this isn’t going to happen.

You must want to think deeply about ideas and how they can mingle.

If you don’t understand an idea, your curiosity should keep you going and allow you to understand it so fundamentally that it becomes fungible across disciplines.

You don’t need to be smart, you simply need to be willing to continuously seek better understanding.

The best way to get what you want is to deserve it.

Be a lifelong learner.

This was one of Munger’s central pieces of advice:

Be curious about the world, willing to learn about everything and anything.

The more you know the better off you are.

And remember - it’s okay if you’re not passionate - there are many ways to get from A to B in life, this is just one of them.

The key is to understand the fundamental ideas across the key disciplines, you don’t have to be obsessed with it for 80 years like Munger (though that definitely does help).

If you want a good place to start, here’s a detailed inter-disciplinary reading list.

The Only Edge With No Expiration

I’m sure there are people who think the mental model discussion is being exhausted.

With so many Youtube channels, blogs, investors, etc… constantly discussing Munger & big ideas, does there come a point where its effectiveness begins to diminish?

The short answer is no.

What I will get from reading Isaac Newton & Daniel Kahneman will be entirely different from what you get from it.

You don’t just read a book and automatically gather every great insight from it; smarter individuals highlight better text, remember the right ideas, and combine them with other ideas more effectively.

The strength of your advantage doesn’t depend on amount of content consumed, it depends on the ability to understand and synthesise content effectively.

Investing is a wonderfully unique profession where it’s encouraged - in fact it’s an enormous edge - simply to be interested in the world.

It’s the rare profession where understanding ant colonies can make you money.

The beauty of individuality is that we can all partake in this journey together yet still benefit in wildly different ways.

The intellectual edge in this case is not blunted by thousands of readers, for you’ll have learnt differently reading this than the next person.

I hope today I’ve inspired you to begin multi-disciplinary thinking.

I’ve personally barely scratched the surface yet feel multiple times smarter than before discovering this idea.

As I said before, if you’re in need of a place to start, I have a reading list which you can access here.

But first, you have to read Hagstrom’s book, Investing: The Last Liberal Art.

It’s the perfect entry to multi-disciplinary thinking.

Here’s to lifelong learning!

Thank you so much for reading.

Sincerely,

The Intellectual Edge

Spot on! This couldn't be more true than for the field of investing. The involvement of various interdisciplinary schools underscores the notion that investing should be approached fundamentally. Disciplines such as engineering, psychology, physics, and astronomy contribute essential skills that are applicable in this realm.

For instance, take a good engineer and teach them core investing topics; they're often best positioned to pick it up quickly and apply their unique competencies to develop innovative research and analysis techniques.

Moreover, many technical chart analysis indicators originate from disciplines unrelated to trading or investing. For example:

Fibonacci: Inspired by patterns in nature.

Momentum Indicators: Derived from principles of physics mechanics.

Cycle Theory: Rooted in astronomy.

These examples only support the fact that skills and insights derived from interdisciplinary schools can significantly enhance investing strategies.

Nicely written. Being an appreciator of mental models and lattice framework thinking. I totally understand your work.

If you had noticed, when people talk, they mention normally something like a “saying”, may be these sayings are real or made up ones, but most of them are mental models connected in their metal framework through their life experiences.

I am sort of doing a research on this subject. Once I have enough, I will publish.

All the best for your works !