Today’s idea helped build a trillion-dollar company.

It’s a mental model that Warren Buffett and Charlie Munger couldn’t live without.

And in light of the recent news about Buffett’s departure, now feels like the perfect time to revisit it.

Buried in Buffett’s 2009 shareholder letter is a nod to one of Munger’s most powerful tools, a way of thinking that helped them navigate six decades of business complexity.

You may recognise this famous Munger-ism:

“Invert, always Invert”

Today’s idea is Inversion thinking.

It is a simple mental trick they used to meander around the many landmines that investing lays in front of us.

Simply put, inversion thinking is when you flip a situation on its head.

Instead of asking, “What could go right?”, you ask, “What could go wrong?”

Let’s say you’re considering an investment. Most people ask:

“What’s exciting about this opportunity?”

Munger would flip that:

“How could this investment blow up in my face?”

By looking at what might fail, you uncover hidden risk.

It makes you approach decision making in an entirely different vein.

You realise how many risks you’re not aware you’re taking.

This video shows Charlie Munger’s definition of inversion thinking, and he gives some great examples

Inversion thinking was a foundational pillar in Munger’s decision making process.

Let’s go through a scenario where us investors would benefit from inverting our thinking:

I have just found a very attractive investment:

Founder-led business

High insider ownership

Market cap under £500mm

UK-based

Growing at 25% p.a.

High ROIC

Boring Industry

If that isn’t the perfect set up, I don’t know what is.

This is destined to achieve the revered 100-bagger status, surely?

Let’s flip the situation on its head.

Here are the questions one would ask in the face of this opportunity:

On the founder:

What if it being founder-led is a problem? Are they drawing excessive compensation? Have they made poor capital allocation decisions in the past? Are governance structures too weak? Is there a succession plan in place?

On Insider Ownership

What if insider ownership leads to entrenchment? Can insiders override outside shareholders? Have they blocked past attempts at change? Are there poison pills or dual-class structures?

What if UK regulation or macro makes it uninvestable? Are there Brexit-related export issues? Currency risks? Cost inflation? Political headwinds like climate policy or local zoning laws?

On Low Market Cap

What if I can’t exit the position? Assume liquidity is a trap. Is average trading volume low? Will it be hard to exit without impacting the stock price? Are institutional investors avoiding it for a reason?

On High Growth Rates

What if 25% growth is unsustainable or even a red flag? What if growth is low-quality? (e.g One-time contract wins, Government grants). What if growth hides operational strain? (e.g. Hiring too fast and diluting company culture). What if growth creates overconfidence? Are they ignoring competitive threats? Launching vanity projects or M&A?

On High Roic

How could high ROIC lead me to make a bad investment? What if the ROIC is inflated by accounting gimmicks? Assume ROIC is not what it seems. Is the denominator (invested capital) artificially low? Off-balance-sheet assets? Leased assets excluded? Are they capitalising expenses that should be run through the income statement?

What if high ROIC is backward-looking? Was it earned under unique conditions? Are returns trending down as the company scales or reinvests in lower-return areas?

Assume the business is running out of high-return opportunities. Is growth slowing despite cash availability? Are new projects returning less than the core? Are they hoarding cash because they don’t know what to do with it?

Assume the business has high ROIC but poor capital allocation. Are they plowing earnings into empire building instead of returning it? Do they make acquisitions that dilute ROIC? Are share buybacks done at inflated valuations?

Suddenly the sure thing investment opportunity has a lot more risks that previously anticipated.

That is why inversion thinking is so powerful.

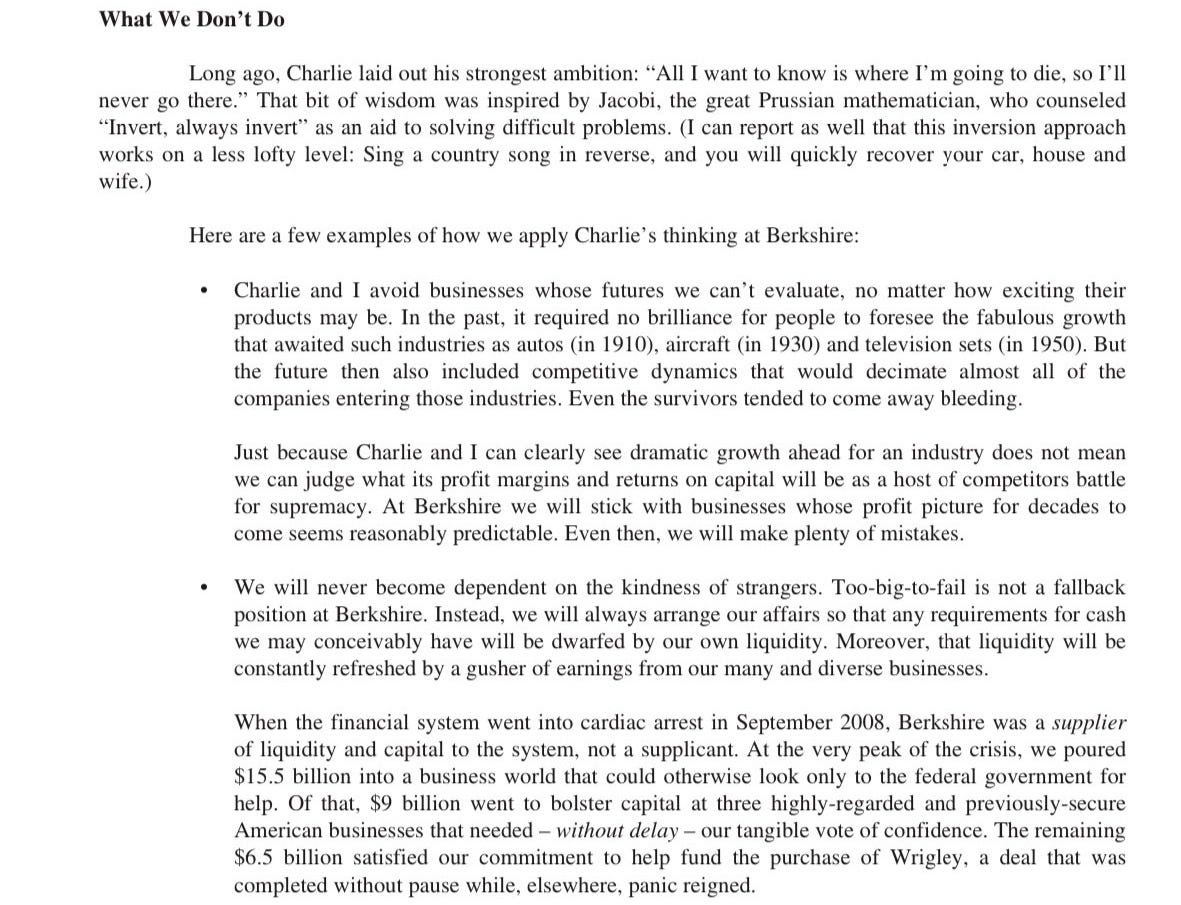

In his 2009 letter to shareholders, Buffett explains how Berkshire have used Munger’s thinking:

If it is good enough for Buffett and Munger to build a $1 trillion company, it’s good enough for us too.

Inversion shouldn’t be isolated to investments, though.

It is a wonderful trick to use in every aspect of life.

What do I need to do to become a really bad partner? Let’s avoid all those things.

What habits should I form to reduce my life expectancy? Let’s avoid those habits.

I could go on and on.

It is a wonderful way to approach situations differently and uncover all of the risks you may have ignored otherwise.

Inversion is how you avoid destruction and stay in the game.

And as Munger often said, staying in the game is everything.

That’s it for today - thank you for reading.

Here’s to inverting, always inverting.

Sincerely,

The Intellectual Edge

Inversion is a powerful tool. In general, successful investors are an extremely confident bunch. Their success, however, doesn’t come from knowing the answer but from continually asking questions and wrestling with the unknown.

Love this. Great read