Investing amid uncertainty - Pt.1

Using payoffs and probabilities to improve investment outcomes

This concept can, without a doubt, make you a better investor. The very best investors use it and we should too.

In a recent two-part series, we covered the fundamentals of probabilistic thinking and briefly explained concepts like expected value, standard deviation and so forth.

Today we’re going deeper into expected value, it’s a large topic that deserves its own series; I promise you, the quality of your decisions can be improved by it.

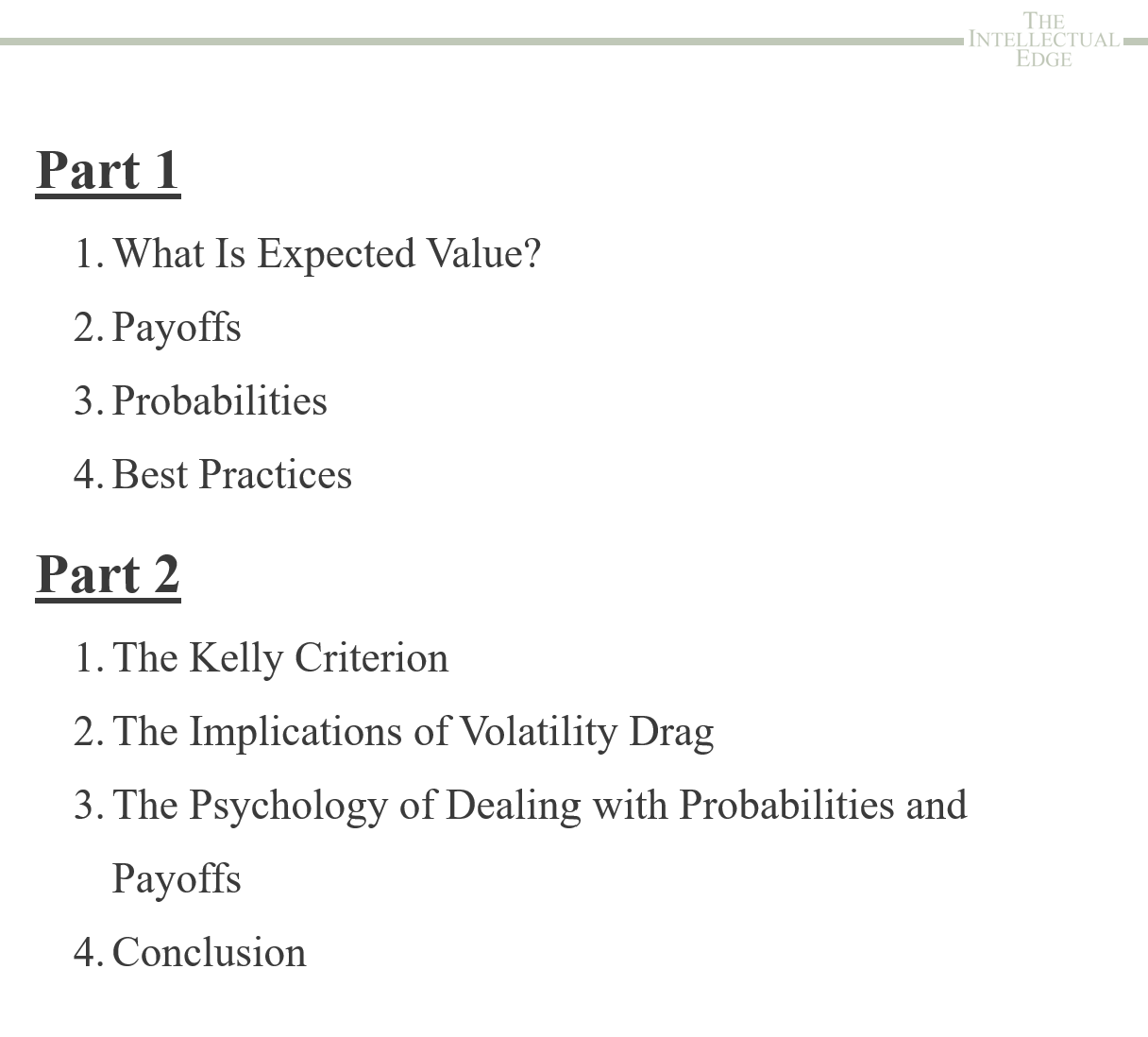

This is another two-part series where I’ll be explaining and analysing a wonderful research paper called Payoffs and Probabilities by Mauboussin et al; here are the topics we’ll dicuss:

Put simply, expected value is a predicted outcome that weighs up all of the probabilities and their payoffs in a given scenario. In situations of uncertainty, expected value helps you analyse outcomes and make a choice based on probabilities (not emotions or biases).

These long form articles are both a way of solidifying my own learning and sharing the insights with you. As I always say, nothing beats the original, which you can find here. If you haven’t the time for its 49 pages, this is the next best thing.

Let’s dive in.